3 reasons travel insurance is essential if you’re traveling abroad

If you’re going to be traveling internationally, you should start looking into your options for travel insurance right away.

Having travel insurance can protect you against unforeseen problems and save you hundreds, if not thousands, of dollars in out-of-pocket costs. Furthermore, many governments demand it.

Do you hope to travel abroad in the near future? Whether you’ve just started planning your trip or have already booked your accommodations, now is the moment to lock down insurance. Three reasons why you should buy travel insurance are outlined below.

Here are three reasons why you should invest in travel insurance before your next overseas adventure:

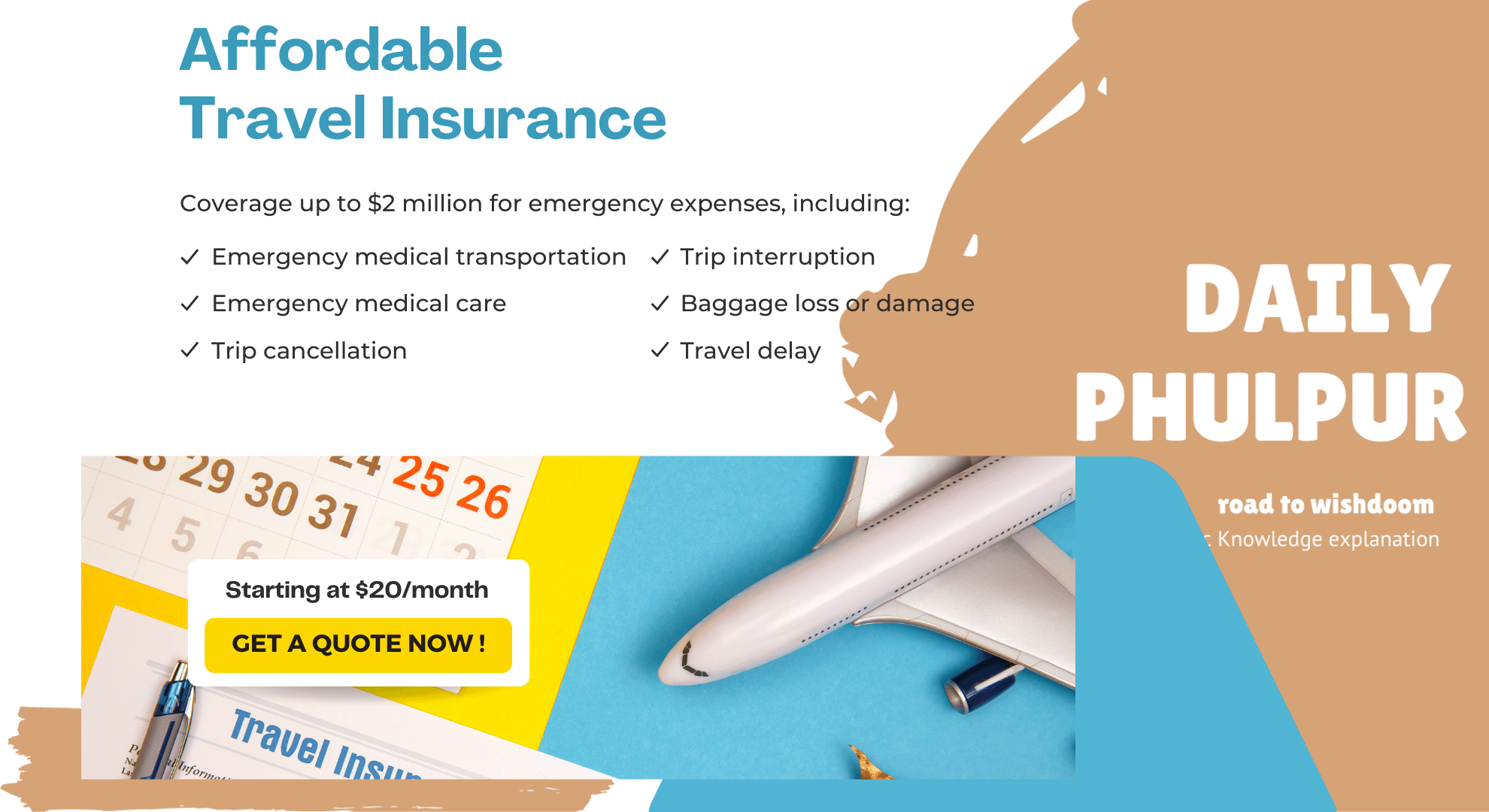

The cost of travel insurance doesn’t have to break the bank. Everything hinges on your choice. Squaremouth, a website that helps users compare different insurance policies, reports that these costs often range from about 5% to 10% of the overall cost of a trip, depending on the individual’s demands.

If you go to a site like Squaremouth and type in your trip information (passenger name, trip dates, location, etc.), you’ll see thousands of insurance plans right away.

To prioritize based on price, rank the available choices from cheapest to most costly. To get going, please visit this page.

However, cancellation, delay, or emergency situations during an international journey frequently result in bigger financial losses than on a domestic trip. Aside from saving money, there are a number of other good reasons to buy travel insurance before going on a trip abroad.

- It can be used to help pay for unexpected medical expenses.

- If you have to cancel at the last minute, this can help.

- As such, it has the potential to prevent bothersome events and even accidents.

- It can be used to help pay for unexpected medical expenses.

- The most important reason to buy travel insurance before leaving the country is if you already have a medical condition or will be gone for a long time.

Since Medicare and Medicaid typically do not cover medical expenses abroad, the U.S. Department of State strongly recommends that all Americans who plan to travel abroad acquire appropriate travel medical insurance. You should check your private health insurance policy or contact your insurance company to see if you are covered while traveling internationally.

In spite of the fact that many modern travel insurance policies are already rather comprehensive and provide a variety of benefits, you may still want to consider purchasing some optional extras. Here is a rundown of some of the best travel insurance providers out there. Get the lookout under way right away.

To avoid having to pay for expensive medical care out of pocket, the Centers for Disease Control and Prevention (CDC) suggests purchasing travel health insurance and medical evacuation insurance.

Foreigners may not be covered by a national health care system even if it exists. “Check your insurance options before you leave in case you need care while traveling,” says the Centers for Disease Control and Prevention.

Peter Greenberg, the travel editor for CBS News, says that some people have to have medical evacuation insurance, which pays for a person to be taken to a hospital if they get sick or hurt while on vacation.

Obtaining medical evacuation coverage is a must. According to an interview Greenberg gave to CBS News in June, “If you are sick or injured outside the U.S., it pays for you to be stabilized medically wherever you are and to transport you home to a medical facility and doctor of your choosing.”

If you have to cancel at the last minute, this can help.

A majority of all-inclusive travel insurance policies cover trip cancellation. If you have to cancel your trip for one of the many reasons stated in your insurance policy, Trip Cancellation Insurance will reimburse you for all or most of your trip costs. You can typically add it to your trip up until the time of departure.

Cancelling a trip or event is understandable if anything out of your control occurs, such as an injury, illness, bad weather, or other emergency. Before you buy travel insurance, you must do a lot of research on the acceptable reasons to cancel your trip.

Most travelers’ biggest nightmare is having to cancel their vacation. With this perk, travelers may rest easy knowing that their trip costs, both prepaid and otherwise, are covered in the event of an emergency. Airfare, lodging, tours, and cruises are all examples of what Squaremouth calls “travel expenses.”

If you think you might need this protection, it’s time to start thinking about your travel insurance options.

In contrast, a Cancel For Any Reason insurance policy will reimburse you for up to 75% of your non-refundable and prepayments if your trip is cancelled for any reason. Get ready to fork over some additional cash if this optional extra interests you. According to Squaremouth, it can lead to a 40–50% rise in your premium. Also, you must book ahead of time (within 14 to 21 days of making your first trip payment).

In some cases, it can even serve as a shield against harm.

A loss of luggage is another reason to purchase travel insurance, in addition to the more obvious ones (medical emergencies and trip cancellations). It can pay you for necessities while you wait for your bag to be returned by the airline, and it can cover a portion of the cost if your bag is lost or damaged.

While this might not appear to be a major problem, mishaps are unfortunately possible.

LuggageHero analyzed data from the US Department of Transportation and found that the top 10 US airlines lost or damaged 685, 000 bags in the first three months of 2022.

When including every airline in the world, this figure grows much larger. LuggageHero reports that December is the most dangerous month for lost bags.

Your whole trip, not just the time you spend in the air, is protected by this policy. Packages that include travel insurance typically come with this added perk. Basically, you should verify everything twice before buying.

There is typically an overall coverage limit, an item limit, and a per-item limit for “Baggage and Personal Items Loss.” According to Squaremouth, which suggests insuring high-priced items worth $1,000 or more separately, many insurance policies list specific things, many of which are expensive.